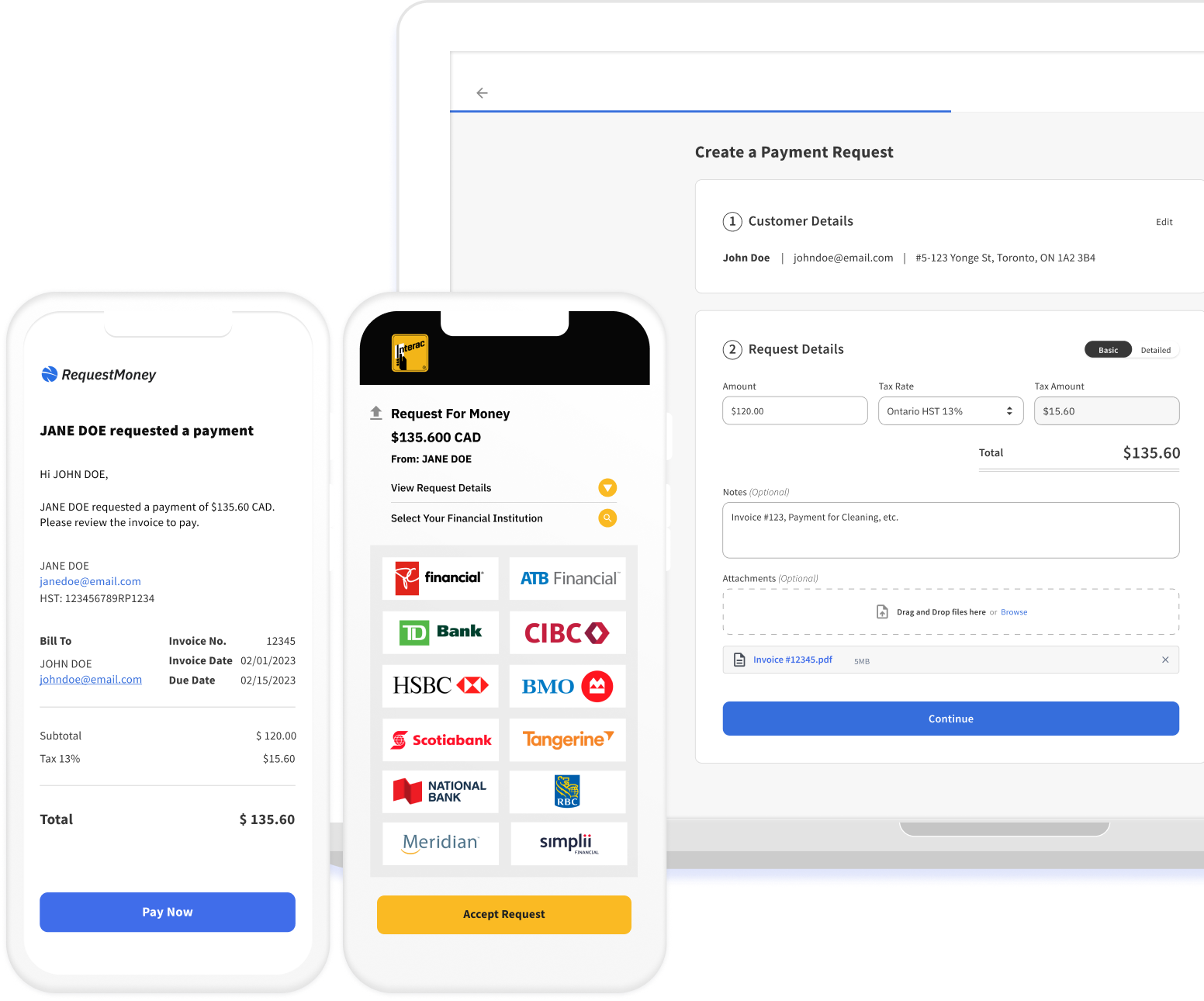

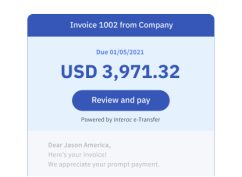

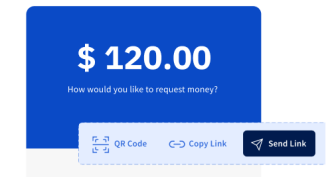

Instant Business Payments with Interac e-Transfer®

If you’re looking to reduce credit card costs and provide

stress-free payment options for your customers try

RequestMoney today!

stress-free payment options for your customers try

RequestMoney today!